Radge Portfolio Allocations

Published August 13th, 2021

What does Nick Radge’s portfolio allocations look like?

I don’t invest in a portfolio of stocks.

I invest in a portfolio of technically driven and 100% systematic strategies.

In other words, I don’t choose stocks. They choose me.

I also don’t invest based on narratives or prediction.

Evidence, or hard data if you like, is what I need. To know, ahead of time, that where I invest my capital has a true edge that will (a) lead to profits, and (b) provide a map of the journey.

An evidence based approach is dynamic, or active, and is known as ‘tactical asset allocation’.

The opposite, such as buy and hold or the 60/40 portfolio, is static. It’s known as ‘strategic asset allocation’

Strategic is driven by motherhood statements such as, “You can’t time the market” or “The only free lunch is diversification”.

It’s popular with those that don’t have the time, the inclination or who are just lazy. And of course those that have a closed mind and aren’t open to other possibilities.

In a future article I will show how a tactical allocation can increase portfolio returns and at the same time reduce downside risks.

For this article I’ll offer a brief outline of how I allocate my own capital, both retirement and other, across various strategies.

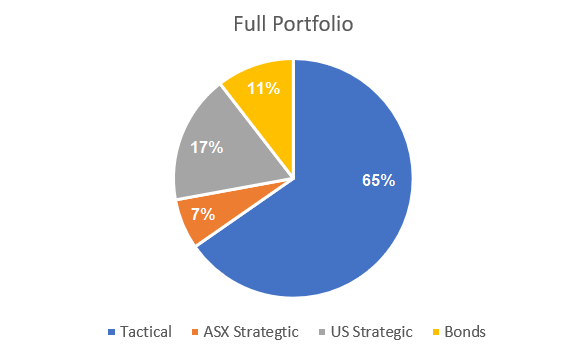

Chart 1.

The first chart below is a top down view of my total portfolio. 65% is allocated to Tactical strategies (more on these below). 11% is allocated to a portfolio of corporate bonds with an average yield of around 7%. The allocations to strategic positions are based on disruptive themes or industry monopolies. Some of these positions have been held for up to 17-years.

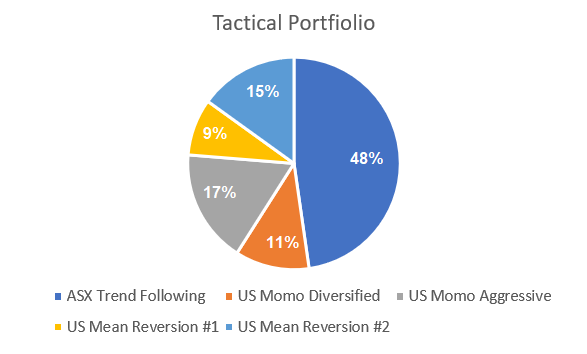

Chart 2.

This next chart digs down into the Tactical allocation.

The majority is our retirement account which uses an absolute momentum strategy on the Australian market and has been operating since the last 90’s. It was designed to simply keep me on the right side of the market and safely in cash during bear market events.

The two Momo strategies are relative momentum strategies, of which the Aggressive is the Premium Portfolio within this site. These slightly differ; the Diversified trades Russell 1000 constituents and holds around 15 positions based on volatility position sizing. The Aggressive, or Premium Portfolio, is a Tech focused portfolio that holds a concentrated 5 positions.

The Mean Reversion strategies are designed to profit during periods of heightened volatility, and provide good accompaniment to trend systems, specifically that they keep trading even if the market is falling.

In summary, a combination of Tactical strategies allows me to diversify across the full spectrum of outcomes; markets, sectors, Factors and time frames.

I’m not sure there is such a thing as the Holy Grail.

But this comes very close.