Hedging Currency Exposure – Learn How to Hedge

Published December 30th, 2021

Global markets provide international investors a large array of opportunities, not only for exposure to their respective economies, but also to specialist sectors within those markets.

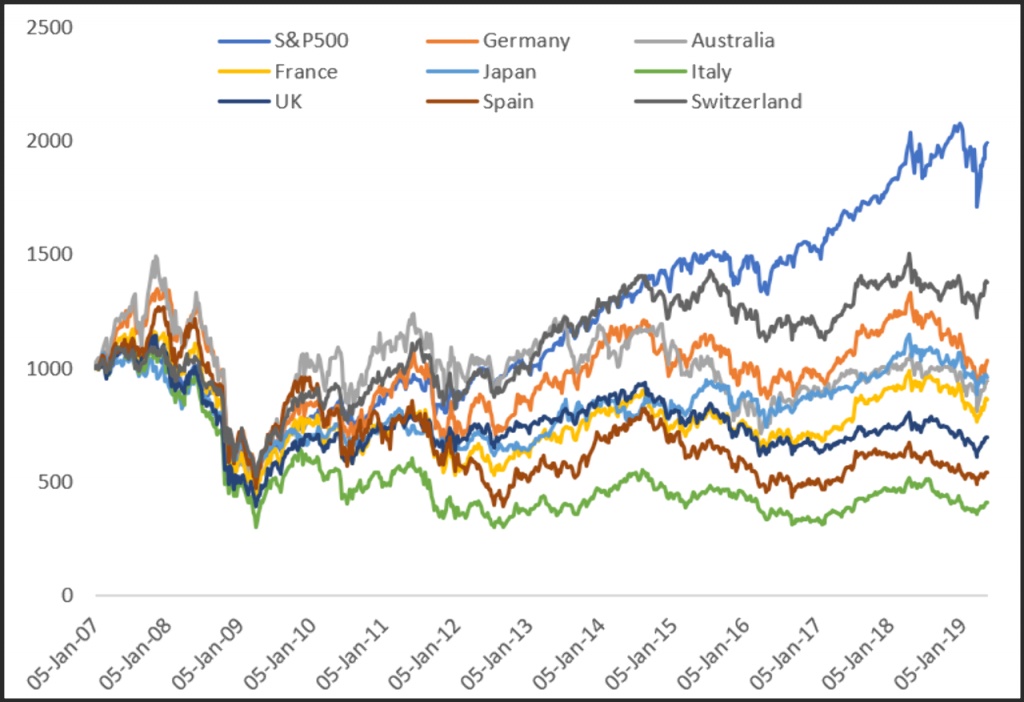

The following chart shows global stock markets priced in US Dollars. Not only is the US the worlds largest economy, it has one of the worlds strongest currencies and also houses the powerful return generator of its technology sector. Since January 2007 the US S&P 500 has outpaced all other global stock markets. It’s a worthy place to be involved.

For many investors, moving away from home markets can be unnerving. Unfamiliar companies, access to brokerage accounts, expense, currency exposure and the ‘great unknown’ can make it all seem too hard.

However, with some research and a little practice, access to foreign markets can be quite simple. The focus of this article is managing the all-important currency exposure.

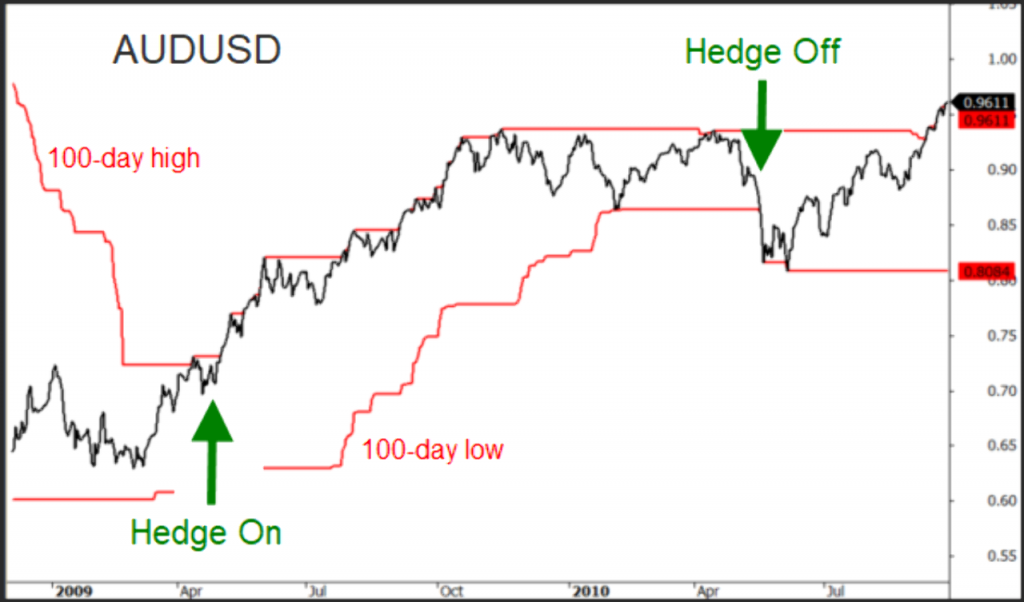

AUD/USD Hedge

As an Australian looking to invest in US securities, I need to buy US assets. To do so I must convert my home currency, Australian Dollars (AUD), to US Dollars (USD).

The risk is while holding those US securities, the AUD could rise against the USD. That will result in a currency loss when I eventually reverse the transaction, and any currency loss will eat into my strategy performance. Of course if the AUD falls I will get some added gains.

My goal, therefore, is to mitigate the possible loss or risk of the AUD rising so I need to hedge that exposure.

An important element here is that a hedge is not designed to generate a profit. It is designed to protect the portfolio. The impact of a hedge needs to be measured together with the strategy P&L.

Some of the disadvantages of hedging currency exposure are:

- can become complex and may require separate accounts

- can be expensive

- can morph into its own trading regime

My preferred hedge vehicle is Australian Dollar futures traded on Globex (CME). The underlying contract value is AUD$100,000. The Initial Margin requirement is US$3,375 per contract making it inexpensive. AUD futures contracts trade in 3-monthly intervals so using a deferred settlement I can hold a position for 6+ months with ease.

My brokerage account allows me to access futures contracts right alongside my securities holdings.

Next, I make the hedge mechanism simple and only protect against large moves. If I get too involved in smaller moves, i.e. the noise, then my costs and workload increase and the hedge becomes a beast unto itself.

There are many ways to trigger a hedge. Methods that could be considered are a breach of an upper Bollinger Band, a 10-month moving average cross, or a 40/200 or similar moving average cross. No one method will be perfect and all will suffice if the focus is on larger moves and steering clear of short term noise.

I prefer a monthly close above (below) the 100-day high of the AUD/USD pair (see chart below). So, my process is:

- If the AUDUSD closes above the 100-day high at month end.

- Buy the 6-month or 9-month deferred Australian Dollar futures contract equal to the value of the home currency exposure.

- If the portfolio is exited whilst the hedge is on, then exit the hedge.US S&P 500 has outpaced all other global stock markets. It’s a worthy place to be involved.