Bear Market Strategy

Published August 17th, 2021

There is a time to be involved in the markets and times when it’s best to sit on the sidelines.

The 2008 crisis proved to be an excellent case in point. Taking the ‘buy and hold’ approach not only destroyed much wealth, but also destroyed the psychological fortitude of many investors. Not being able to pull the trigger due to fear is as much a wealth destroyer as riding a bear market down.

Personally I have always stayed in cash when sitting on the sidelines. My brokerage account does pay some small interest and it all helps the bottom line. (Disclosure: performance data shown for the Premium Portfolio excludes any interest and dividends).

Are there other options available that could help returns when not invested in stocks?

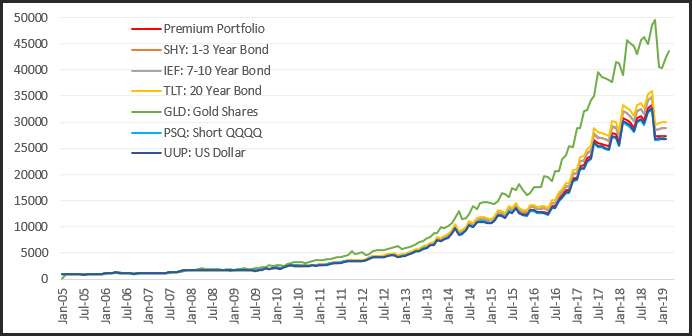

In this article I’ll investigate alternatives to plain old cash, namely a variety of different ETF products. When the system goes to cash based on my Index Filter, the portfolio will sell all open position and purchase an ETF. Start date – 2005. Commissions – included. Dividends – excluded.

On first impression it’s clear that the Gold Shares ETF (GLD) starkly outperforms all others. But a word of warning…

The system only implements 7 additional transactions. With profits reinvested and compounded, the allocation of all assets to a single and volatile ETF such as GLD is an extremely aggressive approach. Without a larger data set extending well back into the last century I would be extremely cautious of the impact of that specific ETF.

What is also obvious, and without the risk, is the 20 Year Bond (TLT), and to a lesser extend the 7-10 Year Bond (IEF), provide additional return without the extreme volatility that GLD provides.

A mixed allocation to both GLD and TLT could be worthy of further research.

Nick Radge -Trade Long Term