Assessing The Market

Published February 17th, 2023

The portfoilio is currently having a tough time navigating the market. The major question is why? And, what should we expect going forward?

The answer is interest rates and the uncertainty surrounding how far the Fed will actually increase rates. So far this year the Fed has raised rates four times; 25bps, 50bps, 75bps and another 75bps in July. This has been the most aggressive move since the Greenspan days of 1994 – 1996. Back then the Fed doubled the cash rate in just seven increases. Indeed the Fed has NOT done two consecutive 75bp increases since 1990.

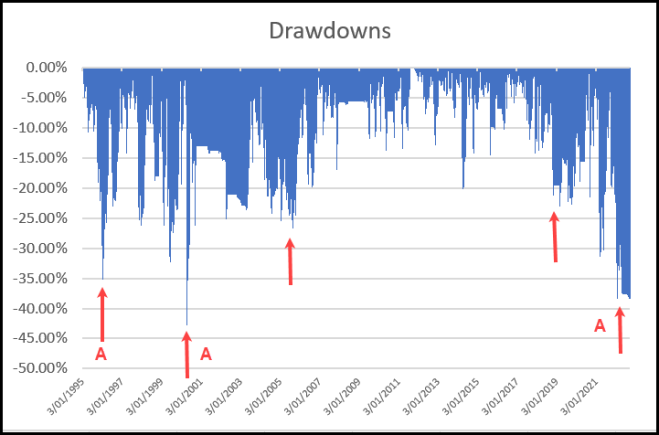

When we look at the Premium Portfolio over the longer term, there is certainly a correlation between interest rate rises and portfolio value declines, or drawdowns. The following chart shows the portfolios equity drawdowns back to 1995. The red arrows are Fed interest rate increases and annotated “A” refers to a more aggressive stance by the Fed, specifically increases exceeding 25bps.

As mentioned above, currently the Fed is being extremely aggressive and by all accounts they haven’t finished yet.

The good news is that they have historically turned their stance around very quickly when things go awry. In February, March and May 2000, they increased rates to 6.5%, but just 7 months later, they slashed rates from 6.5% to 1.75% in the space of 12-months, almost all cuts were 50bps.

The Fed, the economy, the markets, strategy performance and almost everything in life operates in cycles. Good times. Not so good times. The problem is that its impossible to time the good and the bad, which is unfortunately a common mistake made by retail investors. Rather than time the good and bad, it’s more profitable to be involved over the longer term, i.e. ‘time-in’ rather than ‘time-ing’ the market.

The following chart is the combined monthly and weekly equity growth of the Premium Portfolio since 1995.

What we’re currently experiencing is not new and it’s not unexpected. Even with historic drawdowns similar to what we’re currently experiencing, the portfolio still tracks at an annual return of 27%. Many strategies and many global fund managers are experiencing drawdowns in this environment. While these are never comfortable, they are an integral part of the trading process. I strongly believe the difference between those that are successful traders, and those that are not, is the ability to weather drawdowns when they come along.

Trish and I remain fully committed to all our strategies, including the Premium Portfolio. The good times will return. It’s important to be there when they do.