Published July 1st, 2024

Momentum Investing for the US Stock Market

Turn the stock market from a ‘hopeless game of chance’ to a method of systematically growing your wealth

BUY THE STRONGEST STOCKS.

AVOID THE LOSERS

REPEAT.

“Since the 2008 Crisis I’ve been looking for a smarter way to invest – one that helped me capture the growth as a market swings up and minimizes the downside when it falls. I’ve spent so long searching online, reading highly rated books and reading white papers. Then through a stroke of luck I discovered Nick Radge. For the first time ever I felt that I was actually investing with a plan that would work for me whether the market went up or down. Thanks to Nick’s work and my learning I felt confident that in the future I wouldn’t be scared out of the market and I could trade with confidence knowing that following a tested systematic approach I could safely invest for the years ahead.” – Tony S.

MOMENTUM INVESTING IS A TIME-TESTED APPROACH TO STOCK INVESTING

Momentum is a logical, time tested approach supported by vast amounts of academic and industry research gathered over many decades.

Stocks that have done well recently tend to continue doing well in the following months and even years. This is known as ‘price persistence’ and can be found in individual stocks, commodities, foreign exchange and indices. This unique style of investing allows investors to build wealth, navigate changing markets, avoid sustained bearish periods and meet lifelong investment goals.

Momentum investing is a disciplined, three-step process that’s designed to capitalize on the persistence of stock prices.

1. Define the market trend

2. Use the Momo-50 List

3. Manage risk

A rising tide tends to lift all boats, and the same rings true for stock prices. Research clearly shows that buying stocks only during strong market conditions provides significant advantages over buying stocks at any other time.

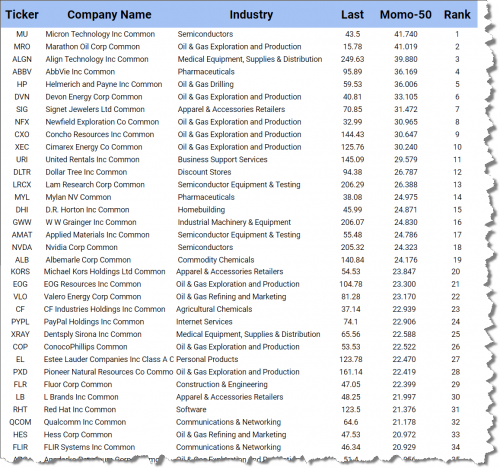

We carefully screen all stocks in the S&P-500 and rank their momentum with our proprietary algorithm to produce our Momo-50 List. This list then becomes an idea generation tool and a great start point for building a high performance portfolio.

Momentum investing ensures winning stocks are kept and losers are discarded. The Premium Portfolio shows that average winners will be 3x the size of losses with a 60% trade accuracy. This positive edge creates long term profitability.

“As retirees we left our Financial Planner and his lack of knowledge behind early this year. That proved a wise move. More losses and anguish would have been avoided had we found Nick [earlier]. Nick’s insights and suggestions have been invaluable, our situation more stable and sleeping has become much easier..” – Helen and Rick L.

SAVE TIME AND PROFIT WITH THE MOMO-50 LIST

Catch the market leaders before they move.

Each weekend our Momo-50 List uses a proprietary algorithm to identify the current market leaders – these are high growth, high beta stocks that can generate 20%, 50% and 100% returns over the coming months.

The Momo-50 List maximizes the markets momentum and allows followers to position themselves in the strongest high growth stocks available, such as MU +186%, NVDA +160%, NFLX +106%, GILD +96%, STX +78% etc

WHY SHOULD YOU JOIN?

1 Research Driven

In today’s social media fixated and instant gratification society it’s easy for investors to make decisions that are emotionally driven and not financially optimal. To remove noise and emotion from the decision making process the Momo-50 List is a research driven and evidence based approach that provides proven outcomes.

2 We Play a Great Defense

You know the old saying, “Don’t confuse brilliance with a bull market.” The key to beating the market is being fully invested when it’s rising and sitting comfortably in cash when it inevitably falls. The Momo-50 List will automatically determine the trend of S&P 500 companies and the Premium Portfolio will move 100% to cash during negative trend periods.

3 Gain Confidence

Large losses from riding poor performing stocks, or suffering through sustained bear markets like the 2008 Crisis, is now a thing of the past. The ingrained habit of holding losers yet selling winners too early can now be systematically eliminated. The Momo-50 List will automatically alert you to weak stocks and poor market conditions. Avoiding these provides a heightened sense of security and confidence to invest regardless of what the doomsayers are saying.

4 Free Access. No Credit Card Required.

The Momo-50 List is a free resource for investors. Updated each weekend you will always have access to the strongest stocks and sectors in the market. Join today and also gain immediate access to a 30-minute educational webinar, ‘Three Things Every Stock Investor Must Do’. This comprehensive webinar will provide a solid foundation for building your own profitable investment business.

ABOUT

I was taught that success comes from original thinking and a refusal to blindly accept statistical models, economic theories, and even ‘common wisdom’ prevailing within the investment community.

Since 1985 my philosophy has been quite simple:

Markets, and specifically individual stocks, manifest themselves in trends. While trends do not exist in all stocks all the time, they do exist in most stocks some of the time.

Simply put, directional price momentum tends to persist long enough to exploit and profit from.

If you’re looking for a clever and calculated way to flip the fear and uncertainty of stock market investing on it’s head, and turn it into a profitable endeavor, then I invite you to watch over my shoulder and follow my momentum investing.

Nick Radge

Any information provided on this website is general advice only and does not take account of investors’ goals and/or objectives, financial situation or needs. Before acting on this general advice, investors should therefore consider the appropriateness of the advice having regard to their objectives, financial situation or needs.