The Risks of Avoiding Risk for Traders & Investors

Published August 17th, 2021

The risks of avoiding risk for you as traders or investors, we will explore what we mean in this article.

The 4th quarter 2018 was brutal for many traders and investors. December itself was the worst December performance for 70-years. Thankfully I was already in cash, but even so, my strategies certainly didn’t fare well in October where Tech stocks reversed very sharply.

The following are typical questions that come across my desk, not only after the recent months, but anytime where markets have sudden and large downdrafts;

“I was doing very nicely and was up at least 15% in a few short months, the market then turned and I watched that gain evaporate in one month. I was wondering if there is any benefit of having a quicker exit strategy like on a weekly basis to lock in gains”. – Ben Y

“By my calculations, your average losing trade is just over -7%. Why was this ALGN trade -33.29%? Just curious what your post-mortem analysis said about this trade. Was there anything you saw that would help you avoid a trade like this in the future?” – Jeremy C.

The Premium Portfolio finished +8% for 2018, but it did give back a lot of profits and very quickly.

As per the readers questions above, can that be avoided? Can stops be tightened? Can I exit earlier?

The answer is yes. But…

At what cost?

I have previously addressed some of these concerns in this short presentation, The Science of Stop Losses.

To avoid a knee jerk and emotional reaction which could be detrimental, I’ll try and offer up a more scientific conclusion using the Premium Portfolio as an example. As you’re aware, the Premium Portfolio is an algorithm based strategy which means we’re able to make adjustments and see how it’s performance is impacted.

In this example I will not amend the actual signal equation – that would create a completely different strategy. Rather I will amend the Index or Regime Filter. (This filter was discussed in a previous article, It’s More Important To Play A Good Defense)

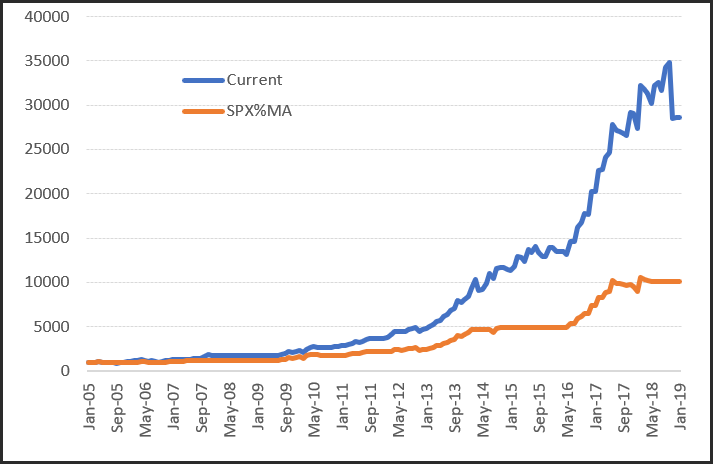

The Index filter I will use will be the percentage of stocks in the S&P 500 that are above their 200-day moving average, which we’ll call the SPX%MA indicator. When the 100-day average of the SPX%MA is above the 200-day average of the SPX%MA at month end, we’ll call the market bullish and invest. When the opposite is true, we’ll call the market bearish and revert to cash.

Chart Example:

The following chart shows that using the above Index Filter would’ve signaled a defense portfolio stance in April 2018 and therefore avoiding both the 4th quarter slump and holding positions such as $ALGN.

So that’s a promising addition that avoids a lot of pain.

But at what expense?

The one thing I have learnt from 34-years at this game is that there will always be an unintended consequence. It’s imperative to understand what that might be before making that emotional decision to adjust the strategy.

Especially when isolating a single event. Because I can assure you, if you isolate this event, there will be some other one just around the corner that will then catch you by surprise.

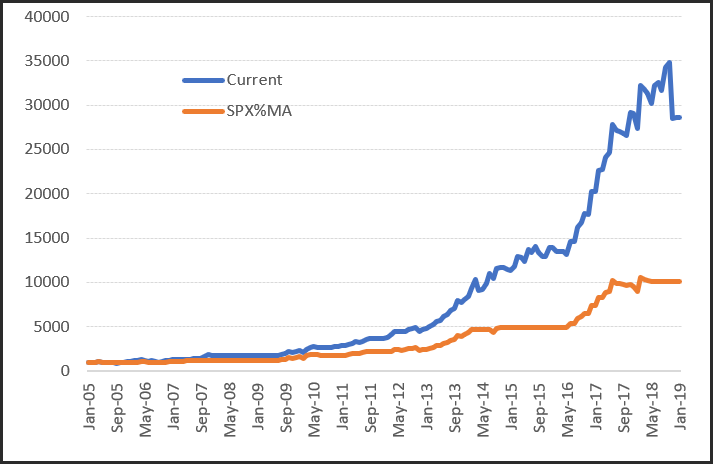

Let’s look at the bigger picture for the Premium Portfolio had we removed the nastiness of 2018. The following chart shows equity growth since 2005 for the current version of the Premium Portfolio, and the hypothetical version using the new index filter.

It’s quite clear that the recent decline in equity was successfully avoided, but so has the benefits of the system over the longer term.

Using the adjusted Index Filter reduces the total return by almost 2/3rds.

That’s the payoff – comfort over return. It’s also why I only allocate about 7% of my total investable funds to this single portfolio. It’s designed to be aggressive and in doing so ‘perks up’ my entire portfolio.

Nick Radge