Play a Good Defense When Trading

Published December 30th, 2021

In my 34 years of trading I’ve never met anyone that didn’t like to make profits.

Yet, for some strange reason, there seems to be an overwhelming number who hate losses.

Go figure.

Unless you’ve been sucked into a Ponzi scheme, you can’t have one without the other.

They come hand in hand.

Successful trading is not supposed to be comfortable. That’s what 1% bank deposit accounts are for.

What’s important for the bumpy ride to success is the emotional impact of losses. They make your mind do weird stuff, which is usually detrimental to the wanted goal of making as much money as possible.

So I recommend working backwards. Think downside before upside.

Because if you can’t handle the downside then you won’t see the benefits of the upside.

Now the markets have been a little bumpy of late so I’d like to show you the empirical evidence of why I’m in cash and how I got there.

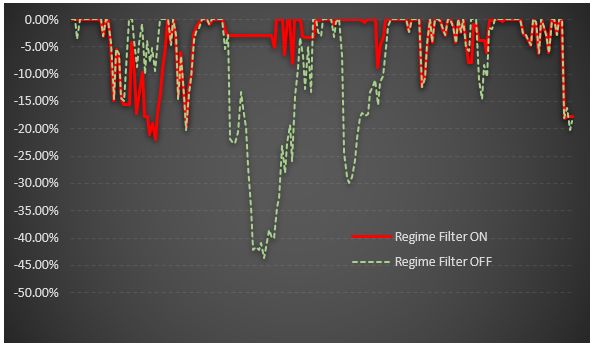

The chart below is called an underwater equity curve. It’s designed to show the drawdowns, or losing periods of a strategy, and specifically in this example we’re using the Premium Portfolio over the last 15-years.

The CAGR for both is more or less the same. But what about the all-important downside?

The light green line shows the impact of taking the Premium Portfolio trading signals without regard to the trend of the underlying market, in this case the S&P 500.

The red line shows the impact of taking trading signals only when the trend of the S&P 500 is up.

This On/Off switch is known as a Regime or Index Filter. It’s designed to limit ongoing losses during sustained bear markets.

Note that when the Regime Filter is used the downside is greatly reduced. There are two 20% declines.

Not comfortable, but not soul destroying either.

And certainly better than having 30% or 40% declines which would be the case had we not used the filter.

The takeaway is you need to make as much money as you possibly can when trends are strong, so you can sit tight and do nothing when trends are poor.

Nick Radge