Tactical and Strategic Trading

Published December 30th, 2021

In last week’s article I discussed my own portfolio allocations which cross the divide of both Tactical and Strategic strategies.

But not everyone is interested in, or has the capabilities, to run multiple Tactical strategies. Time constraints. Capital constraints. Lack of knowledge. The list goes on. (As a side note, if you are interested in becoming proficient in trading strategy design then investigate our Trading System Mentor Course).

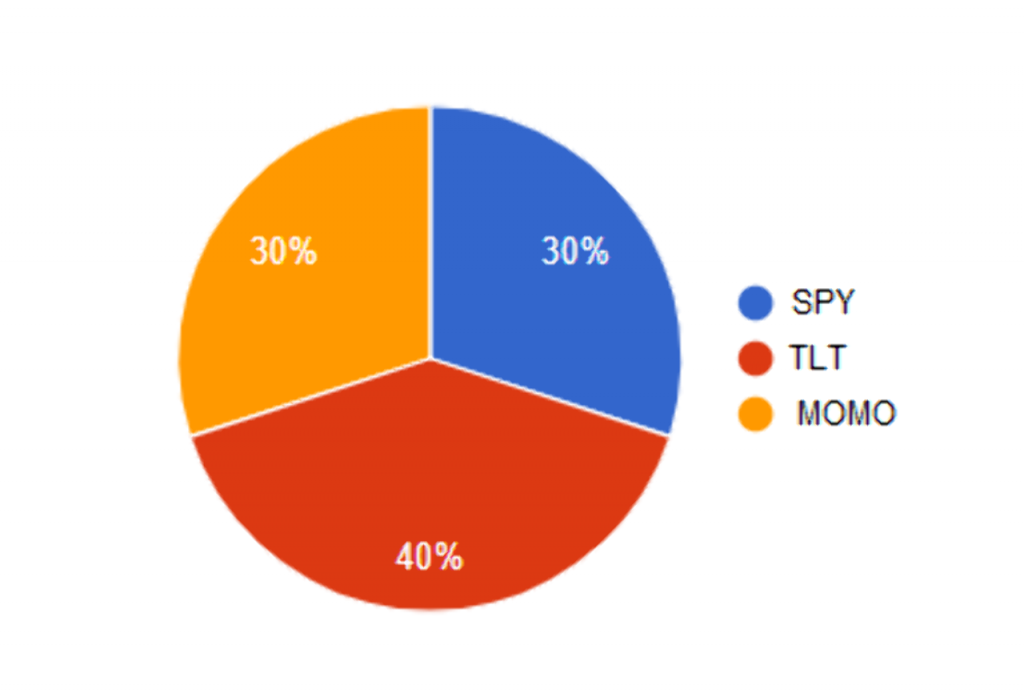

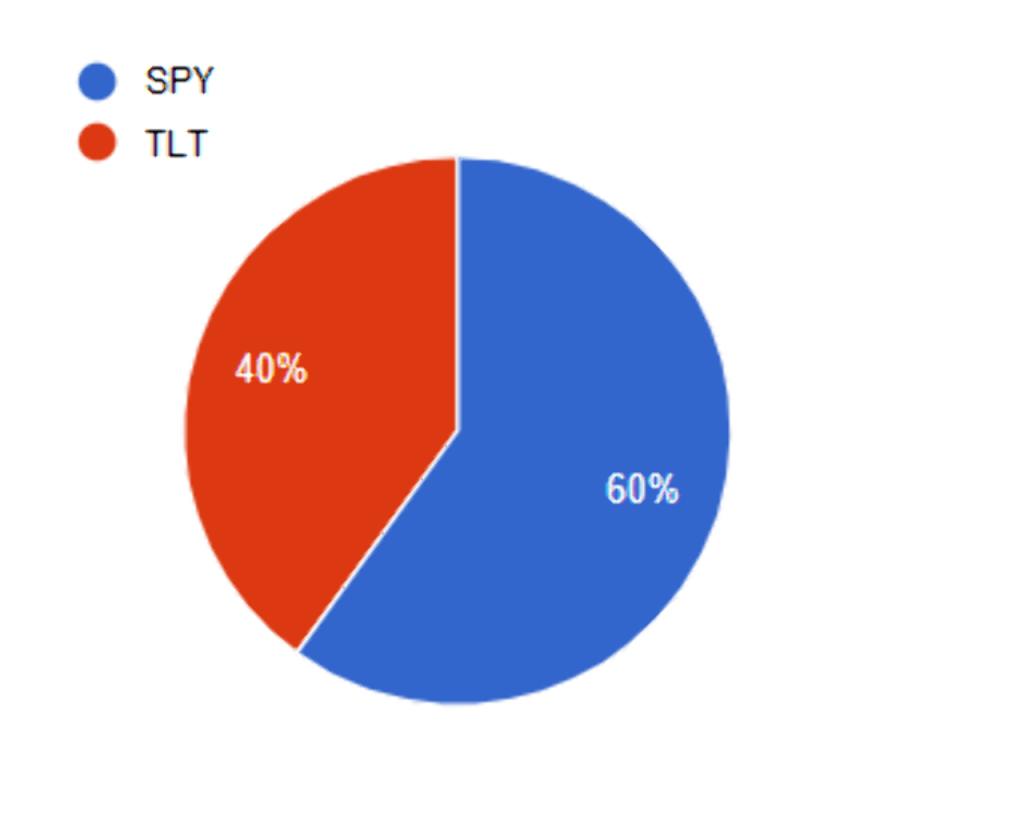

For the regular investor many financial advisors recommend the ’60-40′ portfolio. This is a portfolio made up of 60% stocks and 40% fixed-income securities and usually initiated with ETFs (see diagram below). Advisors have recommended this balance as a middle-of-the-road way of investing. It puts the majority of an investor’s money into stocks, which are riskier but higher yielding than bonds, while still having a solid amount held in government, corporate and agency bonds.

Not only it it simple to understand, it’s also very low maintenance and in ‘most’ cases, bonds will help soften the blow during adverse stock market moves.

However, the equity decline during extreme bear markets. Such as 2002 and 2008, can still be beyond the comfort level of most investors. In my experience the cut-off point for most investors tends to be at about 20% drawdown.

Beyond that investors run for the doors.

Some market commentators have suggested that investors replace the 60-40 split for a more conservative 35-65 split. Apparently this will allow them to better withstand equity declines.

But it’s also likely to leave them short of their retirement nest egg target.

Is there a better solution?

Let’s have a look.

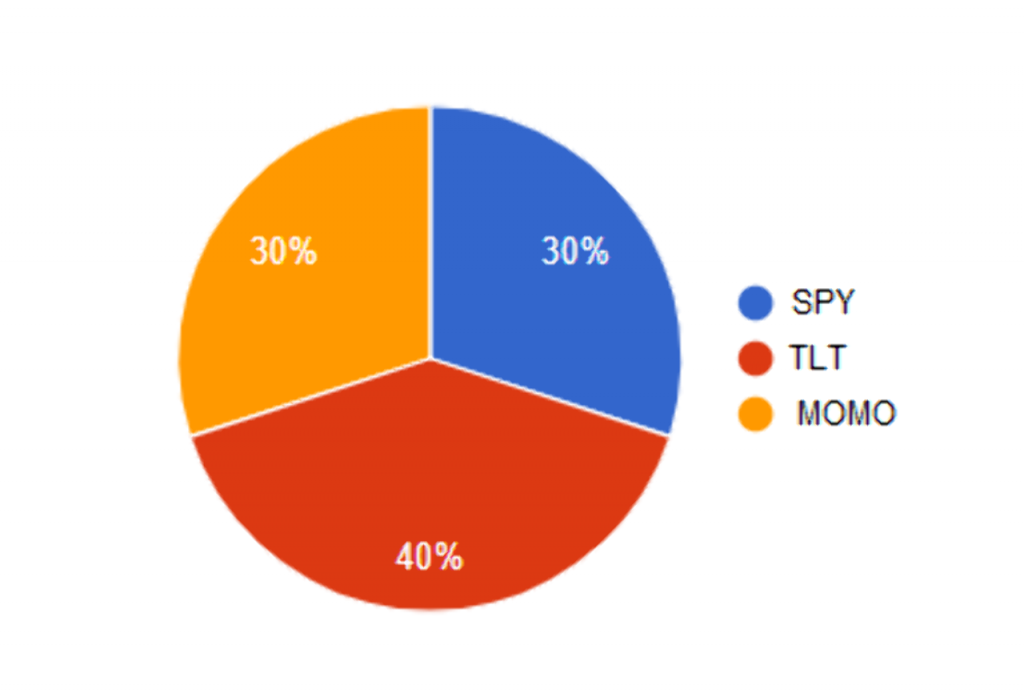

What if we added a moderate allocation to a Tactical strategy, such as the Premium Portfolio? Here’s an example, where we allocate 30% to the $SPY. 30% to the Premium Portfolio (Momo) and leave the other 40% in the $TLT bond.

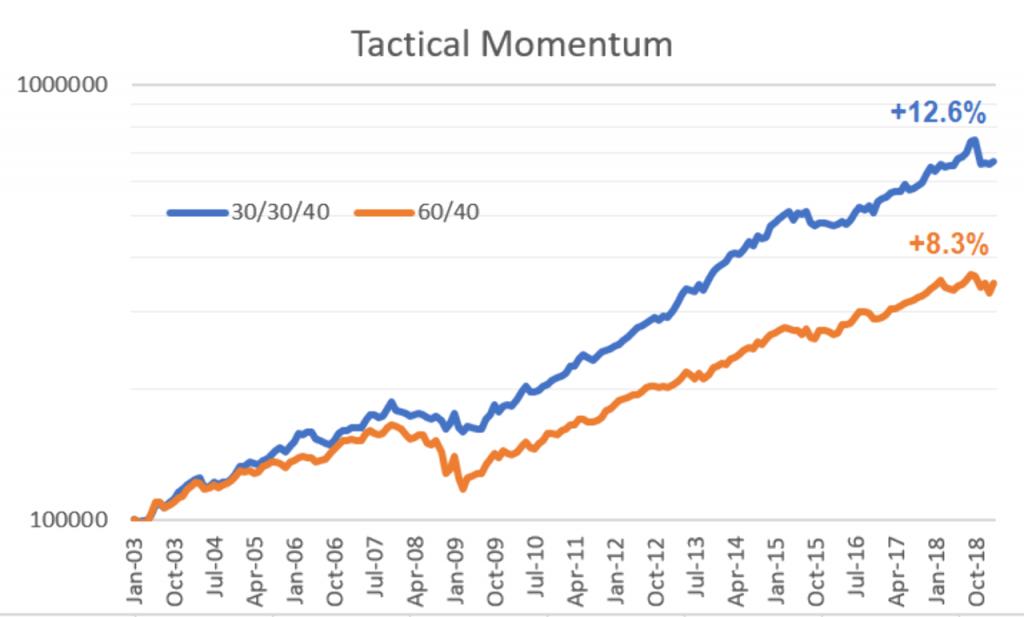

The following chart shows the equity growth since 2003. The more aggressive stance of the portfolio helps lift returns.

But more importantly, the defensive nature of the portfolio. Specifically that the tactical allocation reverts to cash during adverse market conditions, greatly reduces the drawdown.

In summary, taking a passive strategy such as the 60-40 portfolio and adding a tactical strategy, may enhance returns and reduce the drawdown.